The United States Is Facing an Inflation Problem

Inflation could become a very big problem for the U.S. economy, with adverse effects on the wealth and buying power of Americans.

Before going into any details, consider this: between May 2017 and May 2018, prices in the U.S. economy surged 2.6%. This is the highest inflation figure we have seen since 2011. (Source: “CPI-All Urban Consumers (Current Series),” Bureau of Labor Statistics, last accessed June 12, 2018.)

Here’s the kicker: don’t be shocked if inflation figures surge in the coming months and quarters.

There are two big catalysts for this. First, there’s way too much money in the economy. Over the past few years, one could say that there has been massive mismanagement of the money supply. The Federal Reserve printed money and created monetary inflation.

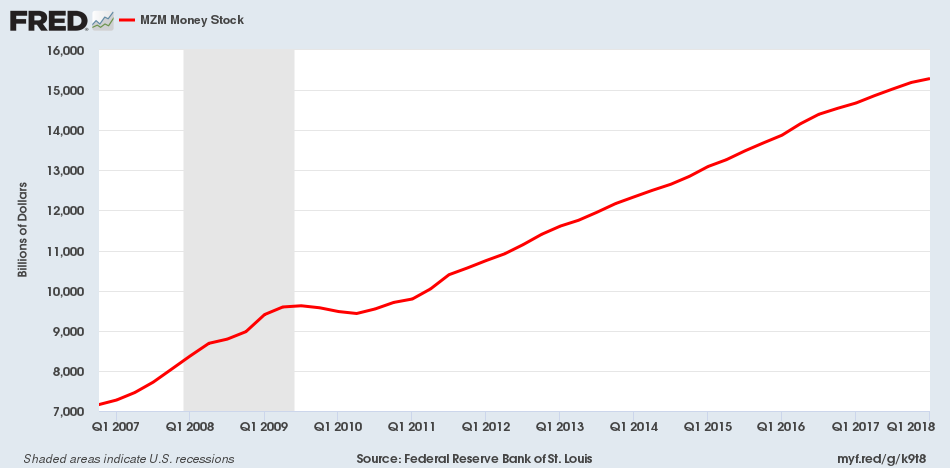

Look at the chart below, which shows the money supply in the U.S. economy.

(Source: “MZM Money Stock,” Federal Reserve Bank of St. Louis, last accessed June 12, 2018.)

In 2008, the money supply was around $8.0 trillion; now, it’s over $15.0 trillion. That’s an increase of 90% over a decade, or, on average, nine percent per year.

Monetary inflation eventually shows up in price inflation, which we are starting to see now.

Second, inflation is usually controlled by central banks. They raise rates and keep tabs on rising prices. The Federal Reserve targets for a two percent inflation rate and adjusts accordingly.

Surely, the Fed is raising rates. However, it has said something recently that’s worrisome: that it will let the inflation run above the two-percent target for a temporary period. (Source: “Fed indicates it will let inflation run above 2 percent goal for ‘temporary period’,” CNBC, May 23, 2018.)

If the Fed is not fighting rising prices, could it be possible that we see the inflation rate surge, even if it’s for the short term? It’s possible.

What Happens If Inflation Rises in the U.S. Economy?

If inflation soars in the U.S. economy, it could have dire consequences across the board.

Inflation destroys wealth. For instance, with prices increasing 2.6% between May 2017 and May 2018, a dollar then is worth just $0.97 now. If you held cash in a bank account, in real terms, you lost money. One could even say inflation is a sort of tax.

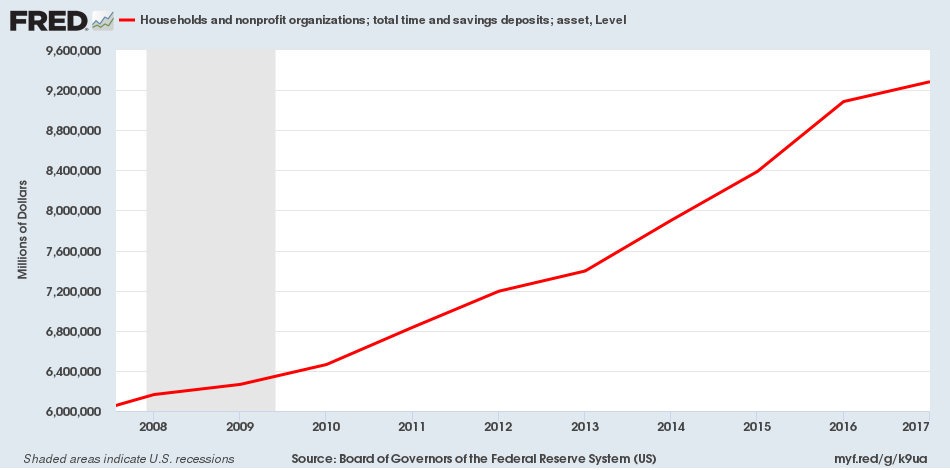

To give you further perspective on how big of an impact inflation could have on wealth in the U.S., look at the chart below. It essentially shows money in a savings account:

(Source: “Households and nonprofit organizations; total time and savings deposits; asset, Level,” Federal Reserve Bank of St. Louis, accessed June 12, 2018.)

Americans have over $9.0 trillion in savings accounts. Let’s be honest, there are not many banks out there that pay over 2.6% on savings accounts as it stands. So, a lot of this wealth could be on the line.

If inflation runs at four percent, in real terms, a lot of savings disappear. While wealth is one thing, rising prices could impact the buying power of the average American.

Wages aren’t really going up, anyway. With rising prices, Americans could be strapped for cash. They may not buy as much, and this impacts the overall U.S. economy directly.

I reiterate what I said earlier: don’t underestimate inflation.